Have you ever wondered if your small business truly needs specialized accounting software, or if a simple spreadsheet will do the job? Managing finances is a crucial aspect of any business, and choosing the right tools can make all the difference.

Small businesses often operate on tight budgets, so investing in software may seem unnecessary. However, specialized accounting software can streamline bookkeeping, automate calculations, and reduce human error. It also helps with tax compliance and financial reporting, saving time and effort in the long run.

Unlike generic tools, accounting software is designed to handle invoicing, payroll, and expense tracking efficiently. It provides real-time insights, helping business owners make informed decisions. While it may seem like an added expense, the benefits often outweigh the costs.

So, do small businesses need specialized accounting software? The answer depends on your business size, transaction volume, and financial complexity. Investing in the right software can improve accuracy, efficiency, and financial health.

Do Small Businesses Need Specialized Accounting Software?

Small businesses often face unique challenges. Managing finances is one of them. Specialized accounting software can help. But is it necessary? Let’s explore.

Do small businesses need specialized accounting software? This question is common among business owners. The answer depends on various factors. Let’s dive into the details.

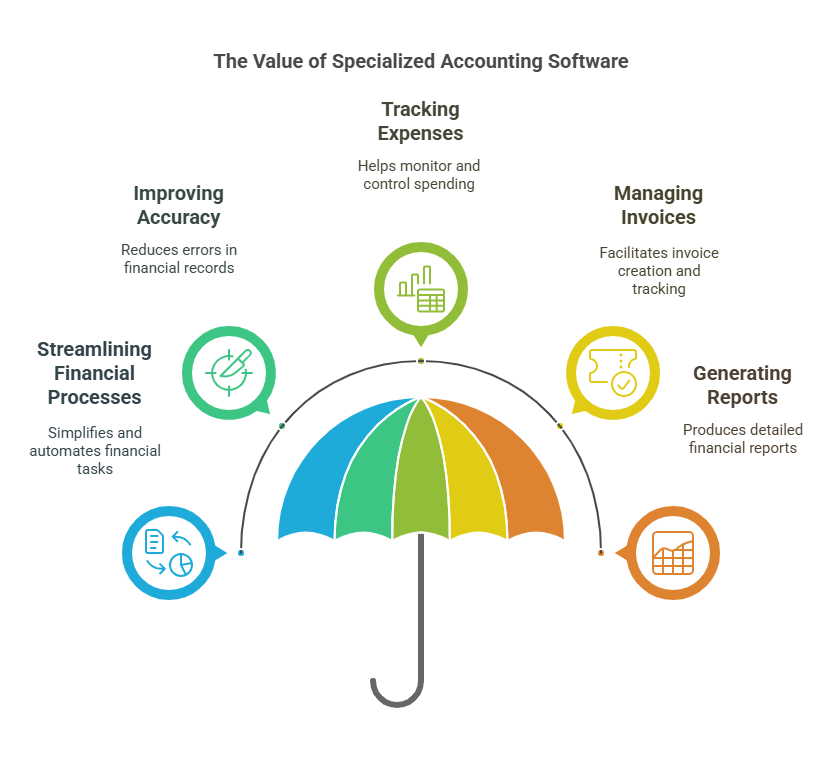

Benefits of Specialized Accounting Software

Specialized accounting software offers many benefits. It can streamline processes, save time, and reduce errors. Here are some key advantages:

- Automation: Automates repetitive tasks like data entry and invoicing.

- Accuracy: Reduces human errors in calculations and data entry.

- Time-saving: Speeds up financial processes, allowing focus on core activities.

- Compliance: Ensures adherence to tax laws and regulations.

- Real-time data: Provides up-to-date financial information for better decision-making.

Challenges Faced by Small Businesses

Small businesses often struggle with financial management. Limited resources and time constraints are common issues. Manual accounting can be time-consuming and prone to errors. Specialized accounting software can address these challenges.

Common Challenges and Solutions of Accounting Software

- Data Security and Privacy:

- Challenge: Accounting software stores sensitive financial data, making it a target for cyberattacks and data breaches.

- Solution: Implement strong security measures such as encryption, multi-factor authentication, and regular security audits. Ensure that the software provider follows industry best practices for data protection.

- Integration with Other Systems:

- Challenge: Integrating accounting software with other business systems (e.g., CRM, ERP, inventory management) can be complex and may lead to data inconsistencies.

- Solution: Choose accounting software that offers robust integration capabilities. Work closely with IT professionals to ensure seamless data flow between systems and regularly monitor data integrity.

- User Training and Adoption:

- Challenge: Employees may find it difficult to adapt to new accounting software, leading to resistance and underutilization of its features.

- Solution: Provide comprehensive training sessions and ongoing support to help users become proficient with the software. Encourage a culture of continuous learning and offer resources such as user manuals and online tutorials.

- Cost of Implementation:

- Challenge: The initial cost of purchasing and implementing accounting software can be high, especially for small businesses.

- Solution: Evaluate the software’s long-term benefits and potential cost savings. Consider cloud-based solutions that offer flexible pricing models and reduce the need for significant upfront investment in hardware.

- Customization and Scalability:

- Challenge: Standard accounting software may not meet the unique needs of every business, and scaling the software to accommodate growth can be challenging.

- Solution: Choose software that offers customization options and is designed to scale with your business. Work with the software provider to tailor the solution to your specific requirements and ensure it can handle increased transaction volumes as your business grows.

- Data Migration:

- Challenge: Migrating data from legacy systems to new accounting software can be complex and prone to errors.

- Solution: Plan the data migration process carefully and involve experienced professionals. Perform thorough data validation and testing before fully transitioning to the new system to ensure data accuracy.

- Software Updates and Maintenance:

- Challenge: Regular software updates are necessary to keep the system secure and functional, but they can disrupt business operations if not managed properly.

- Solution: Schedule updates during off-peak hours to minimize disruption. Stay informed about upcoming updates and prepare users in advance. Consider using cloud-based solutions that handle updates automatically.

- Technical Support:

- Challenge: Access to reliable technical support is crucial for resolving issues promptly, but not all software providers offer the same level of support.

- Solution: Choose a software provider known for excellent customer service and support. Establish clear communication channels with the support team and keep detailed records of any issues and resolutions.

By addressing these common challenges with thoughtful solutions, businesses can maximize the benefits of accounting software and ensure smooth, efficient financial management.

Impact of Specialized Accounting Software on Business Efficiency

In today’s fast-paced business environment, efficiency is key to staying competitive. One of the ways businesses can enhance their efficiency is by adopting specialized accounting software. This software is designed to automate and streamline various accounting processes, leading to improved accuracy, time savings, and overall operational efficiency.

Streamlined Processes:

- Automated Transactions: Specialized accounting software can automatically record and categorize financial transactions. This reduces the need for manual data entry, minimizing errors and saving valuable time.

- Real-time Data: The software provides real-time access to financial data, allowing businesses to make informed decisions quickly. Managers can monitor cash flow, track expenses, and assess financial performance at any given moment.

- Integration: Many accounting software solutions can integrate with other business systems, such as inventory management and customer relationship management (CRM) software. This integration ensures that data flows seamlessly between different departments, reducing redundancy and enhancing overall efficiency.

Accuracy and Compliance:

- Error Reduction: Manual accounting processes are prone to human errors, which can lead to financial discrepancies. Specialized accounting software reduces the risk of errors by automating calculations and data entry.

- Compliance: The software often includes features that ensure compliance with local tax laws and regulations. This helps businesses avoid costly fines and penalties associated with non-compliance. The software can also generate tax reports and file returns electronically, further simplifying the compliance process.

Cost Savings:

- Reduced Labor Costs: By automating repetitive accounting tasks, businesses can reduce their reliance on manual labor. This can lead to significant cost savings, as fewer employees are needed to manage the accounting processes.

- Efficient Resource Allocation: With specialized accounting software handling routine tasks, employees can focus on more strategic activities that add value to the business. This efficient allocation of resources can lead to increased productivity and profitability.

Enhanced Reporting and Analysis:

- Customized Reports: Specialized accounting software allows businesses to generate customized financial reports. These reports can provide insights into various aspects of the business, such as profitability, cash flow, and budget performance.

- Data Visualization: Many accounting software solutions offer data visualization tools, such as graphs and charts. These visual representations make it easier for stakeholders to understand and analyze financial data, leading to more informed decision-making.

Scalability: As businesses grow, their accounting needs become more complex. Specialized accounting software is designed to scale with the business, accommodating increased transaction volumes and additional users. This scalability ensures that the software remains effective and efficient, regardless of the business’s size.

Specialized accounting software has a profound impact on business efficiency. By automating processes, improving accuracy, and providing real-time data, it enables businesses to operate more effectively and make better-informed decisions. Additionally, the cost savings, enhanced reporting capabilities, and scalability make it a valuable investment for businesses of all sizes.

Cost Considerations

Cost is a significant factor for small businesses. Specialized accounting software can be expensive. However, the benefits often outweigh the costs. Improved efficiency and accuracy can lead to cost savings in the long run.

Integration with Other Systems

Integration is crucial for seamless operations. Specialized accounting software can integrate with other business systems. This ensures smooth data flow and reduces redundancy. It also enhances overall efficiency.

User Training and Support

Adopting new software requires training. Employees need to learn how to use the software effectively. Good software providers offer training and support. This ensures a smooth transition and maximizes the benefits.

Customization and Scalability

Every business is unique. Specialized accounting software can be customized to meet specific needs. It can also scale with the business as it grows. This flexibility is essential for long-term success.

Security and Data Protection

Data security is a top priority. Specialized accounting software offers robust security features. Encryption, multi-factor authentication, and regular updates protect sensitive financial data.

Case Studies

Real-life examples can illustrate the benefits. Here are a few case studies:

- Small Retail Business: A small retail business implemented specialized accounting software. It automated inventory management and invoicing. The result was improved efficiency and reduced errors.

- Healthcare Provider: A healthcare provider adopted specialized accounting software. It streamlined billing and compliance processes. This led to significant time savings and better financial management.

- Consulting Firm: A consulting firm used specialized accounting software. It integrated with their project management system. This improved project tracking and financial reporting.

Future Trends in Accounting Software

The future of accounting software is promising. Here are some trends to watch:

- Cloud-Based Solutions: Cloud-based accounting software is becoming increasingly popular due to its accessibility, scalability, and cost-effectiveness. Small businesses can access their financial data from anywhere, collaborate with team members in real-time, and benefit from automatic updates and backups.

- Automation and Artificial Intelligence (AI): Automation and AI are transforming accounting processes by reducing manual tasks and improving accuracy. AI-powered tools can handle data entry, invoice processing, and even generate financial reports. This allows small businesses to focus on strategic decision-making and growth.

- Blockchain Technology: Blockchain technology offers enhanced security and transparency for financial transactions. It can help prevent fraud, ensure data integrity, and streamline auditing processes. Small businesses can benefit from the trust and reliability that blockchain brings to accounting.

- Mobile Accounting Apps: With the rise of mobile technology, accounting software is becoming more mobile-friendly. Mobile accounting apps allow business owners to manage their finances on the go, track expenses, send invoices, and access real-time financial data from their smartphones.

- Data Analytics and Business Intelligence: Advanced data analytics and business intelligence tools are becoming integral to accounting software. These tools provide valuable insights into financial performance, help identify trends, and support data-driven decision-making. Small businesses can leverage these insights to optimize their operations and improve profitability.

- Integration with Other Business Systems: Accounting software is increasingly integrating with other business systems such as customer relationship management (CRM), inventory management, and payroll. This integration ensures seamless data flow between different departments, reduces redundancy, and enhances overall efficiency.

- Enhanced Security Measures: As cyber threats continue to evolve, accounting software providers are prioritizing security. Advanced encryption, multi-factor authentication, and regular security updates are becoming standard features to protect sensitive financial data.

- Customization and Scalability: Small businesses have unique accounting needs, and software providers are offering more customization options to meet these requirements. Additionally, scalable solutions ensure that the software can grow with the business, accommodating increased transaction volumes and additional users.

- Outsourcing and Virtual Bookkeeping: The trend of outsourcing accounting tasks to virtual bookkeepers is on the rise. Small businesses can benefit from the expertise of professional accountants without the need for in-house staff. Virtual bookkeeping services often use advanced accounting software to manage finances efficiently.

- Continuous Learning and Professional Development: As accounting software becomes more sophisticated, continuous learning and professional development are essential. Small business owners and their teams need to stay updated with the latest features and best practices to maximize the benefits of their accounting software.

These trends are shaping the future of accounting software for small businesses, making financial management more efficient, secure, and insightful. By staying informed and embracing these advancements, small businesses can gain a competitive edge and drive their success.

FAQs

- What is specialized accounting software? Specialized accounting software is designed to meet specific business needs. It offers features like automation, integration, and customization.

- How does specialized accounting software improve efficiency? It automates repetitive tasks, reduces errors, and provides real-time data. This saves time and allows focus on core activities.

- Is specialized accounting software expensive? The cost varies. However, the benefits often outweigh the costs. Improved efficiency and accuracy can lead to cost savings.

- Can specialized accounting software integrate with other systems? Yes, it can integrate with other business systems. This ensures smooth data flow and enhances overall efficiency.

- Is data security a concern with specialized accounting software? No, specialized accounting software offers robust security features. Encryption, multi-factor authentication, and regular updates protect data.

Conclusion

Do small businesses need specialized accounting software? The evidence suggests that they do. Specialized accounting software offers numerous advantages, including improved accuracy, time savings, and better financial insights. These benefits allow small businesses to operate more efficiently and make informed decisions, ultimately driving growth and success.

Investing in specialized accounting software may seem daunting due to the initial costs. However, the long-term gains, such as reduced errors, streamlined processes, and enhanced compliance, make it a worthwhile investment. By adopting the right software, small businesses can focus on their core activities and leave the complexities of financial management to the software.

In summary, specialized accounting software is a valuable tool for small businesses. Its ability to automate tasks, provide real-time data, and ensure accuracy can significantly impact a business’s efficiency and success. Consider integrating specialized accounting software into your business to harness these benefits and thrive in today’s competitive market.